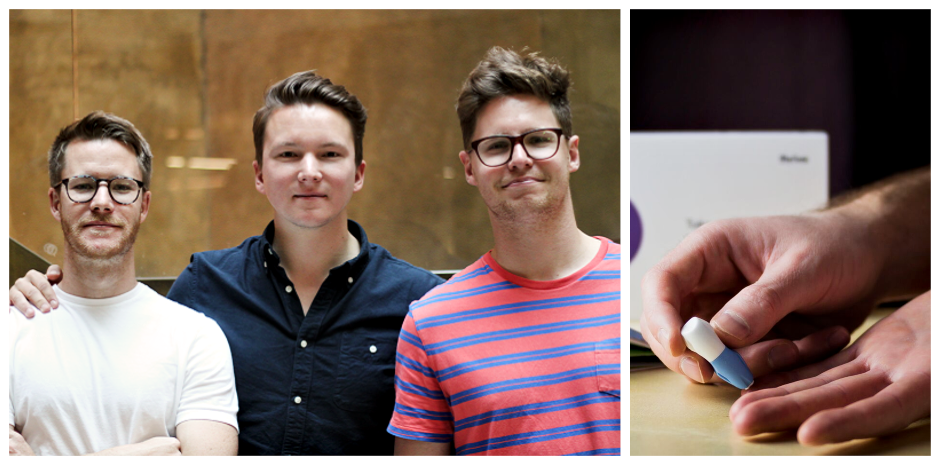

Digital Health startup – Thriva – is a use-at-home mail-order blood testing kit helping people have better control over their health.

Thriva offers the tracking of several health biomarkers from a single finger-prick blood test and the results are given within 48 hours.

The health tech business, co-founded by Hamish Grierson, 32, just last year, recently raised £1.5m in seed funding to scale the business and give consumers more control over their health and data.

Investors supporting the company include Alex Chesterman, founder, and CEO of Zoopla; Taavet Hinrikus, CEO and founder of TransferWise; as well as leading early-stage venture funds Seedcamp, 500 Startups and the London Co-Investment Fund (LCIF).

Hamish’s ultimate aim is to make the tracking and understanding of consumer’s health changes as easy as ‘jumping on the weighing scales’.

How Did You Discover the idea

One of the 3 co-founders – Eliot Brooks – has a hereditary high cholesterol disposition which means he has to test his blood every 3 months. When I and Eliot worked together, we got to discussing why the testing processed felt so antiquated and so anti-customer. It was through that lens that the wider issue became so apparent. That nobody has any insights on an on-going basis which is precisely why people get nasty surprises from their body.

What’s Unique About The Thriva Kit

We’re creating a brand and a product designed for anyone. We’re here to help people go from a position of ignorance about their bodies to one of informed strength. We happen to have started with analysing blood because there’s a huge amount you can tell from it and the majority of factors can be positively impacted by lifestyle change.

The Successful Seed Round – How Did You Do it

The honest answer: I did whatever it takes. I learned lots of lessons and would do it differently if I had the time again. That said, I couldn’t be happier and more proud of the fantastic backers we’re now working with.

Is This Your First Investment Round

We previously raised a small Angel round which was really all about us quitting our jobs and enabling us to go full-time on Thriva.

Getting Funding Support From Number Of Investors – E.g. TransferWise and Zoopla Founders.

Those guys have a couple of key traits in common: They have very good pattern recognition. They could see the macro trends we’re operating within and believe we have what it takes to execute against the opportunity.

Why The Huge Interest From Investors On The Potential Of Technology Transforming How Healthcare Is Delivered

The software is, indeed, eating the world. And the way I see – investors have come to realise that health is, in many senses, a data problem. And though you often find health business crossover outside of software (as Thriva does), many of the key challenges map across from other sectors that have seen disruption abound.

Your View On The Healthtech Sector And How It’s Reshaping Itself Digitally

Fundamentally, this is about a devolution of power. People talk about ‘the patient as the customer’ and I think there’s a lot of truth to that. For too long, people have, in a subtle way, perceived that someone other than themselves had the agency of their health destiny.

But as a society, we’re waking up to the fact that nobody will ever care more about your health than you do or be more able to influence the fate of your health. The rise of wearables was probably the first bounce of the ball on that front.

The Interest In Running Your Own Startup

The appeal of the shiny glass towers and large corporates who pay big salaries has never quite made sense to me. I was fortunate enough to make it on to an incredible program called the New Entrepreneurs Foundation 5 years ago and have spent the time since then refining my commercial, product and strategic skills whilst working with some brilliant people inside other organisations.

What’s The Next Plan for the seed funds

We’re always conscious of the profit/growth/fundraising trade-off. In reality, given the time-bound nature of the opportunity, we’ll likely be raising again in 12 months or sooner.

Images Copyright – Thriva / edited by I Am New Generation Magazine

More Stories

How Can Startups Navigate The World Of Grant Funding

Co-Founder Story – Going Into Business With My Friend