Too often we have heard stories of minority-led businesses, in particular those within Europe, having their ideas sometimes treated with contempt or misled into thinking they are not investment-worthy.

Well, this black-owned venture capital firm Impact X Capital, launched in 2018, is tired of discussing these problems and are actively funding people of colour and women innovators within Digital and Technology, Health and Education, Lifestyle, Media and Entertainment sector.

The VC fund, under the management of serial entrepreneur Eric Collins together with co-founder Paula Groves, is inspired by the lack of investment in underserved founders and they want to create the next Google, specifically by the Black community in Europe.

Impact X believes there is a lot of benefit in financially backing minority companies as they “over-index in terms of hiring and promoting under-represented employees.”

This, in turn, gives these marginalised workers the “opportunities and the experience to be able to work elsewhere or go from startups to major organisations” – therefore creating a ‘circle of empowerment’ as some will later decide to start their own enterprise.

The idea behind Impact X

Eric Collins: The fact that less than one percent of venture capital goes to people of colour – Black people in particular; and that less than four percent goes to women-led teams, means there is a capital market inefficiency.

This gap in funding provides the opportunity to inject capital into underrepresented founder teams at excellent valuations and with the opportunity to generate significant returns on invested capital.

In fact, this persistent capital market inefficiency means that enterprises started by underrepresented entrepreneurs are on average likely to be able to deliver a higher rate of return for investors than other venture investments.

Underrepresented businesses being underfunded

Eric Collins: Looking at Europe back in the summer of 2018, I started a study to determine whether there were really companies in Europe that could benefit from VC and how many could I find.

I was able to find 100 relatively quickly by just using my network – One person would introduce me to 10 other people and they introduced me to ten other people, etc. That’s how I was able to get the quantification of what is the actual funding need from a risk capital perspective.

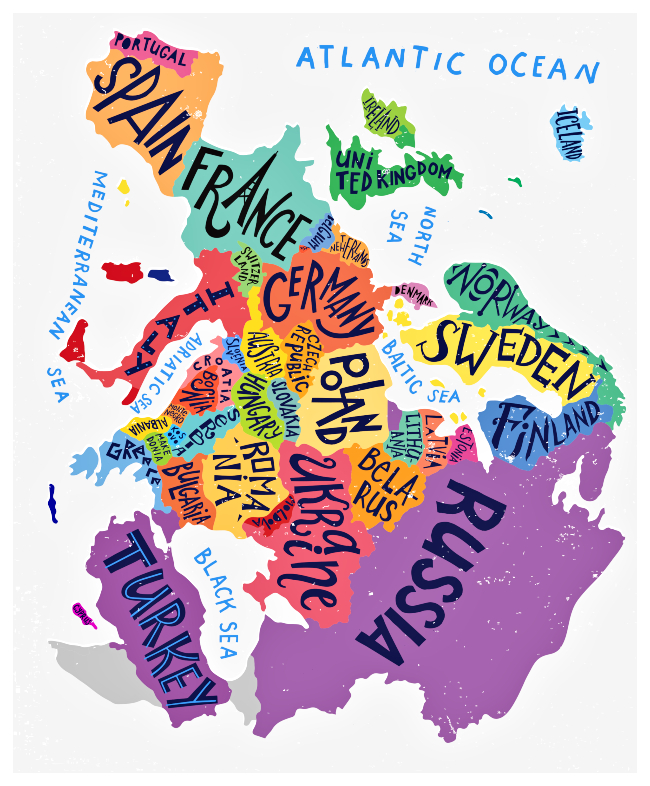

That then led me to make a proposal to a group of investors that we should actually look at, not just the UK, but Europe more generally, and we should look at broad business sectors because when we look at the population – places like France, Germany, Sweden – there are pockets around Europe of Black people and most have entrepreneurship at their core.

Across Europe, we found that entrepreneurship could be a useful driver of any number of things. We uncovered that Black people over-index in digital and technology involvement when we survey Europe.

We also found that Black people over-indexed across Europe in terms of media and entertainment as well as health, education and lifestyle.

So those sectors are where we looked to base our investment thesis – underrepresented European entrepreneurs in 3 sectors.

How many businesses have been funded to date

Eric Collins: We have in our pipeline approximately 500 mostly European companies that we have identified within less than 12 months. There are a few in the US, a set from Africa…a few from the Caribbean. We have vetted about 200 of those.

We have committed to 18 of those and we have closed on 13 of those. The investment rounds ranged from a £500,000 seed extension to a Series A round of approximately £3.2 million.

These were entire funding rounds which didn’t come only from Impact X.

Are you able to give us an example of one of these companies

Eric Collins: One is a company called Predina. Predina is a fascinating organisation which ticks all the boxes. It is an AI company with a Saas business model. The company was started by a serial entrepreneur and came out of a respected incubator.

The company is able to predict up to 7 days in advance, where road accidents will occur. Its emphasis is not displaying the fastest route from point A to point B, but what is the safest route.

Taking people along the safest route, Predina is creating public confidence in direction assistance. This will be a requirement in the future as autonomously driven vehicles take to the roads.

The benefit in investing in minority founders

Eric Collins: Since minority businesses have not gotten VC support at a rate that equals their population, therefore by actually investing in these companies, that have not been served well in the current financial market, an opportunity exists for significant financial returns.

The most savvy investors don’t only invest in things that are safe, they invest in things that have some risk because they know that higher potential rewards come with higher risk investments.

The return potential for VC investments is significant, although risky, and that’s why Impact X invests in venture-backed companies in general. So few of these are being invested in by other venture capital funds.

How does Impact X want to change the narrative

Eric Collins: We want to make sure that underrepresented entrepreneurs are availing themselves of the opportunities that are only possible through venture capital and make sure that they are accessing sufficient pools of venture capital.

VC is what is behind organisations like Amazon, Monzo, HP, Revolut, Shea Moisture – all these big names were driven early on by venture capital injections. Small investments made in the early stages of the organisation’s growth are vital to creating disruptive companies.

Everyone knows about Mark Zuckerberg, Jeff Bezos and Steve Jobs – those are often told stories. Hopefully, people know about Robert Johnson who started BET and they know about Cathy Hughes who started Radio 1 (now known as Urban One).

Both of whom are billionaires having exited through IPO. All those companies started with VC as their base. The real secret is – not to just need funding but be ready to take VC.

VC is not for every business and every VC fund is not for every entrepreneur.

Is this the right time now for what Impact X is doing

Eric Collins: This is not the right time. This should have been done 30 years ago, this should have been done 40 years ago.

And we contend that if it had been done 30 or 40 years ago Black Europe would be in a very different place, in terms of Black involvement in tech, Black people’s net worth, and Black people’s involvement in VC.

We can’t continue to wait on this to happen.

Women and people of colour accessing the VC fund

Eric Collins: It is easy to get in touch with Impact X because all you have to do is go to our website. There’s a link there and you’ll be asked to fill in an intake form, and it will list for you the sort of question we’ll be asking you.

You don’t have to be introduced to us. But you’ve got to be able to answer the questions in a way that creates a venture-fundable opportunity.

We have been so excited with what we have seen in terms of the pipeline. There’s never a problem for us finding quantity or quality. Quite frankly, we believe that the next Amazon will be coming out of Europe and the underrepresented entrepreneur world.

I get a lot of inbound queries like “I’ll like to have a mentor”, “I’ll like to talk to you about an idea that I have” – that’s not us.

We are institutional investors and you have to come prepared with your best foot forward and you’ve got to know exactly what you want and how you are going to address my VC need of how I can get 10x back from what I put into your company.

Images Copyright – Impact X Capital / Shutterstock

More Stories

Voices of ‘diverse women’ – Why the world is ready!