I often see entrepreneurs bragging about how they dropped out from University to launch a business – I hope this is proof that you can do both.

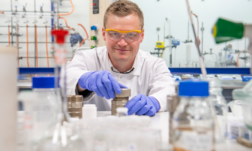

Simon Crowther launched his flood defence business ‘Flood Protection Solutions’ just three weeks after starting his Civil Engineering course at the University of Nottingham in 2012. He explains how he survived student life while using his student loan money to fund his enterprise.

“I managed my business while also successfully completing my Civil Engineering degree in 2015 with a 2.1.

My studies undoubtedly aided the company’s progression and helped us grow into one of the UK’s leading flood defence companies, with customers including the NHS, Environment Agency and Thames Water.

I’m often asked, why flood defence?

Back in 2007, our family home was flooded and we were out of the house for nearly a year whilst it was repaired.

We never wanted to go through the upheaval, expense, or stress again, so I bought a Canadian Water-Gate barrier to help protect our home from future flooding.

In 2012, once again, the weather of which you would usually see in the tropics hit the village.

The main street became a brown, fast flowing river, only this time we were prepared.

We rolled out the Water-Gate barrier and it completely prevented our home from flooding.

Suitably impressed, I researched the product and found out that it was available in 30 countries around the world, except the UK.

I wanted to make the product available here to help prevent other families from the trauma we had experienced and to help them to safeguard their home.

I contacted the manufacturers and subsequently secured the sole UK distributor rights.

A few weeks later, Flood Protection Solutions Ltd was born.

I was the first cohort at University with the increased student fees and was concerned about the level of debt I would have.

I decided to live at home in my first year, and this allowed me to use some of my student loan to establish the business.

Once it was set it up, I opted to live with university friends for my second and third year so I could fully experience student life.

This was a great decision and the life skills learned were invaluable, but it did mean I had to juggle running a business while studying for a degree and having a social life.

I remember occasions where I had strict coursework deadlines, which clashed with the logistics of the business but I still had to ensure both were completed on time.

The downside of moving out of my family home was that money was very tight.

My student loan was not enough to cover my rent, let alone any living expenses, and my parents did not have the funds to support me either.

I remember hitting the limit of my overdraft and having nowhere to turn.

I asked the University for financial aid and I was rejected.

The suggestion was, unbelievably, to consider stopping the business and taking up part-time work.

I’m very glad that I didn’t follow this advice as the business began to prosper and I could now take a small wage, which couldn’t come soon enough.

By my 3rd year I was earning a good wage – more than most graduate jobs would pay, yet still able to study and complete my degree.

To my peers, the situation did seem a little strange, but I remained determined and well-rounded.

Looking back, I’m not quite sure how I managed to juggle both a business and a degree, but luckily it all worked out although it did involve a lot of hard work, late nights and stress.”