We must get this balance right – the impact on the economy and on the financial wellbeing of individuals could be huge, and in a positive way.

I finished secondary school in 2008 and was lucky enough to have attended both a private and grammar school over the course of my education.

As grateful as I am, one thing that has always stayed with me is that I wasn’t ever taught about financial literacy.

At least not directly.

The closest I came to learning about money at school was in GCSE economics, or when completing the odd maths problem, but the focus tended to be on the theory of how money and business worked, rather than how I would go on to interact with the two as an adult.

I stumbled into adulthood like many of us did, with no real understanding of basic concepts like debit and credit, how to read a payslip, or how taxes and pensions worked.

And while I’ve always been entrepreneurially minded – I used to design and sell flyers as a student – starting a business never seemed like a viable path out of the formal education system for me.

Two decades on, the formal education environment doesn’t seem to have changed all that much.

To be clear – financial education is a part of the national curriculum and has been since 2014. Although it took years of campaigning to make this happen, students are still left wanting.

According to a 2019 study by the London Institute of Banking and Finance, 82% of students would like to receive more financial education in school, and 60% would like it to be taught as a separate subject.

Meanwhile, a 2018 Money Advice Service study found that only 31% of schools were timetabling financial education in its own right.

The coronavirus pandemic has greatly affected school leavers this year, and with youth unemployment projected to surpass one million 18-24s in 2020, we must ensure that our young people are given the tools to adequately prepare them for later life.

There are a great many charities and youth organisations who are doing work in this area and I do applaud them.

Some examples include Young Enterprise, who I volunteered with last year to deliver their fantastic Learn2Earn programme to year 10s in a south London school.

At the start of the year, I sat in on an excellent personal finance workshop for 16-25s, co-hosted by MyBnk and Business Launchpad.

Lastly, during the lockdown period, I have personally delivered two finance workshops, digitally, through my company Mr MoneyJar in partnership with youth organisation 2-3 Degrees.

In all instances, the young people in attendance were keen to learn and very engaged.

There is an extent to which this issue may be a generational one.

Young people who go through the formal education system without any financial literacy training grow up to become adults without a proper grasp of how the system works, making them less likely to be able to pass the education on.

Perhaps this is why in 88% of schools, financial education is most commonly taught by staff without training or specific qualifications.

While I would like to see the efforts to teach financial education in schools maintained, I would also like to see these efforts be supplemented by alternative forms of learning and delivery mechanisms.

The charities and youth organisations I’ve just mentioned are an example of one such alternative to the formal schooling system.

Online learning initiatives such as Money Saving Expert’s recently launched online ‘Academy of Money’, is a step in the right direction.

Let’s not forget about the potential of social media platforms too.

In June, TikTok announced that they will be commissioning hundreds of experts and institutions to produce educational content for the platform, which boasts 800 million monthly active users almost half of which are 18-24 years old.

According to The Money Charity, 12.8 million UK adults had less than £1,500 in savings and average household debt stood at £60,363 as of March 2020.

A society in which everyone was educated about money would help people to make better financial decisions.

With the UK currently braced for the economic fallout of the coronavirus pandemic, now is as important a time as ever to ensure that we recover well.

Post By – Timi Merriman-Johnson, founder, Mr MoneyJar / Instagram @mrmoneyjar

Images Copyright – Pexels.com

More Stories

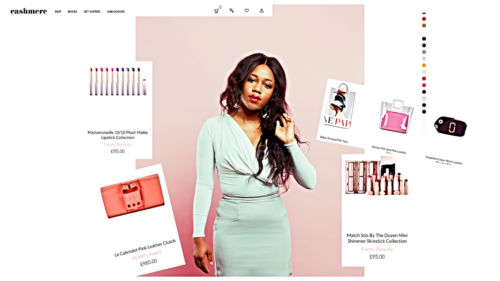

Fashion Meets Finance With Urenna Okonkwo’s ‘Cashmere App’

Startups: How To Spend The Seed Money You Get On An Incubator

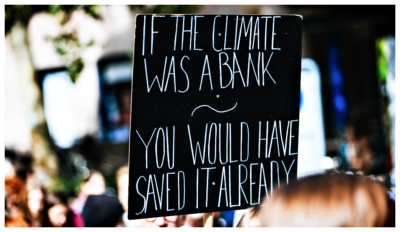

As a young scientist…the economy will always exist but we want our future to be stable and safe