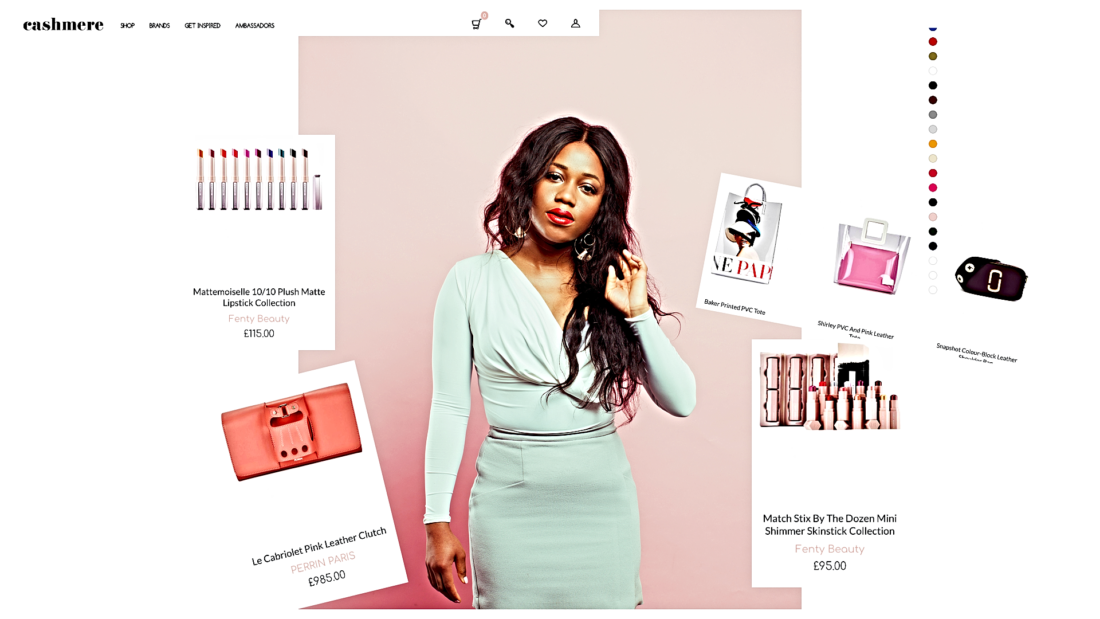

This fintech social savings platform for fashionable millennials is all you need now to live as lavishly as possible without having to dip into your savings – All thanks to Urenna Okonkwo’s Cashmere app.

Cashmere app uses MangoPay digital wallet to help young women save regularly each month to spend on luxury items without the need to use up their savings.

The e-commerce platform, launched in February by 26-year-old tech founder Urenna Okonkwo, wants to show that high-end products can be afforded in a much more financially responsible manner.

“I don’t think I ever actively sought out to become an entrepreneur. I’ve just always been someone that enjoys executing ideas“

“I created Cashmere app to solve a personal need of mine.

The name came about during a brainstorm session in the early days. I wanted something that wasn’t too obvious but left a feeling of comfort, cleanliness, and warmth.

I also chose the name given that cashmere is a luxury fabric and has the word cash in it.

I’ve always been a lover of luxury fashion from my teenage years but my disposable income couldn’t justify me spending huge amounts on luxury as much as I would like.

The idea for Cashmere came to me a couple of years ago while I was in Harrods with my friends – I saw a pair of shoes that I fell in love with until I saw the price tag.

Although I had the money to buy the shoes, which were about £600, I felt guilty using the money in my savings account to buy a pair of shoes that I didn’t budget or plan for.

I ended up not buying the shoes, and that evening I thought to myself, if I had a special stash of cash earmarked for these sort of luxurious experiences – money I was putting away week or month – then I wouldn’t have felt guilty.

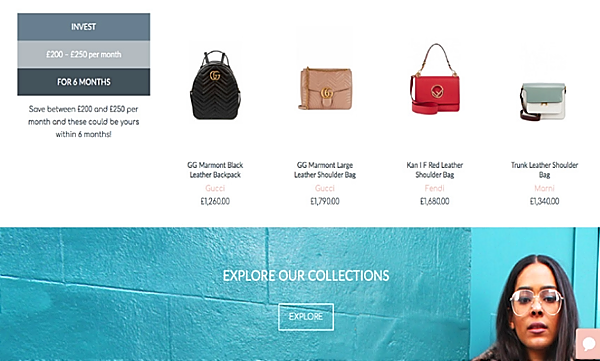

Luxury is unaffordable for many millennials which means many people tend to either not make a purchase or stick to entry-level luxury products such as small leather goods or fragrances.

When I came up with the idea for Cashmere, whilst working full time as a financial adviser at a private wealth management firm, I went around speaking to lots of women to understand their luxury spending habits.

I asked two main questions – ‘Do you like luxury fashion’ and ‘Have you ever made a luxury purchase?’.

If the answer to the second questions was ‘No’, I delved deeper to understand why they hadn’t ever made a purchase.

The reasons ranged from – not being able to plan ahead → feeling guilty about using their personal savings to splurge because they feel like their savings should be earmarked for something more responsible, for example, an emergency fund or mortgage.

This means that luxury brands are not effectively converting their fans to big-ticket customers.

Therefore, I created a tool that helps you to put some money away based on your disposable income, helping you save for the items you want.

Cashmere is a smart savings platform that helps women and girls save for and buy luxury fashion goods and experiences, guilt-free and without having to dip into their personal savings.

“Personal finance is still a topic that isn’t taught in schools which is a real shame”

Once a user is signed up, they set how much they want to save each month and the money is deposited into their Cashmere wallet.

Once they have saved up enough money for an item they want, they can make the purchase via the Cashmere website.

Users also earn reward points the more they save via Cashmere which they can use to unlock special rewards.

We operate mainly on an affiliate model – for example, we receive a commission on each sale from our brand partners – and, additionally, users pay a £3.50 service charge when they make a purchase.

We currently have a number of affiliate partnerships with luxury retailers like Harvey Nichols, Liberty, Vestiaire Collective, Saks Fifth Avenue, Coach, Giuseppe Zanotti and many more.

In addition to helping our community save up for their favourite luxury goods and experiences, we also run money management workshops and talks to empower women and girls to be more financially secure.

Personal finance is still a topic that isn’t taught in schools which is a real shame.

It means that such knowledge will mainly be available to those who have access to parents and networks that understand the importance of financial education.

For example, those with affluent or privileged backgrounds.

I want Cashmere to be the number 1 digital financial partner for millennials helping them save up for the goods and experiences they care about.

My vision is to inspire and empower the everyday woman or girl to enjoy the luxury goods or experiences she wants while also being financially savvy about it.

I come from a personal finance background working as a financial adviser for about 4 years.

However, I’ve always found the industry very stuffy given that I am a very creative person and there isn’t much room to be creative in that world.

Digital technology has always been something I have loved from a young age, mainly from a consumer point of view.

And fashion has been second nature to me for a very long time. So building a platform that combines these three passions of mine felt inevitable.

I never actually had any plans to be an entrepreneur. I always thought I would stay in the corporate world and work my way up the ladder.

I fell into this world by accident – I had an idea, researched it, built and launched it and it turned out to be a business.

I don’t think I ever actively sought out to become an entrepreneur. I’ve just always been someone that enjoys executing ideas.

During the early stages, I worked on Cashmere in the early mornings before work, my lunch breaks, evenings after work and weekends.

I funded Cashmere myself from the start because I strongly believe it’s important to bootstrap for as long as you can, especially when you’re finding ‘product-market fit’.

“They don’t expect a Black woman to be running a fintech company”

Bootstrapping definitely teaches you to how to be lean when running a business compared to having hundreds of thousands of pounds at your disposal at the very early stages.

Now that I am ready to scale Cashmere app, I’ve just raised £150,000 from an angel investor to aid this.

As you probably know, it is very hard for black women to raise investment for their businesses. I was once told to hire a white male cofounder to improve my chances of getting investment.

I’m not the type of person to be fazed by much, as I always try to find a solution to every difficulty I face.

However, I would probably say the biggest difficulty I’ve faced is people, particularly men, underestimating me because I am a first-time founder or because they don’t expect a black woman to be running a fintech company.

So for me to be able to achieve this on my own within a relatively short period of time was huge for me and the business.

The feeling you get when creating something from scratch that people love and gain value from is so addictive.

There are millions of apps out there and it is so easy to be lost in all of that.

If you want to be as successful as apps like Facebook, Instagram, and Snapchat, then you need to create something people want in a way no one else has done before.

Be obsessed with the problem you’re trying to solve. A lot of times we focus on the solution to the problem rather than the actual problem.

Really understand your why – If you can’t answer these questions, you have to have a long think as to whether you’re building this startup for the right reasons.

Running a business is very hard, it’s not as glamorous as it looks so it has to be something that you are willing to give your all to make it a success.”

More Stories

HOW TO: Turn Your Customers Into Brand Evangelists

Getting The Right Partnership For Your Social Impact Business