These financial lessons are a must for every entrepreneur to learn – It’s no secret that new businesses have a high failure rate and the lack of financial control often plays a role.

Within the business sector, it’s true to say that money makes the world go round.

If you want to secure your future and build a reputable, successful company, then you need to learn how to manage your money and maintain a tight grip on your finances.

It’s wise to keep a close eye on the books from the outset by making use of budgeting software and monitoring your business’s cash flow.

Here are some simple lessons every entrepreneur should learn to survive:

Lesson 1 – Budgeting

If you’re used to using a personal budget software at home, then this will stand you in good stead when it comes to managing your business accounts.

Budgeting is key, not only to help prevent over-spending but also to highlight areas where you could potentially cut back to maximise your profits.

While it is possible to run your business using traditional budgeting techniques, it’s advisable to invest in modern applications and software programmes, which offer features that make it easier to monitor profit and loss and adjust your budget on the go.

Budgeting enables you to see how much money is coming into the business, how much you’re paying out, and what you can save or reinvest.

If spending is high in certain areas, for example, staff travel expenses, you can look at ways to bring these figures down and improve your profit margin.

Lesson 2 – Controlling Cash Flow

Cash flow problems are one of the most common causes of startup failure – it’s very common for companies to have money tied up in unpaid invoices or incomplete projects, and often, businesses don’t have the financial stability to stay afloat.

It’s crucial to keep on top of the books so that you can identify potential cash flow issues, and try and come up with a solution.

This is particularly important in managing your business income if you are, for example, running a Christmas shop or an agency that offers tours and excursions in the summer.

You’ll need to use the funds you generate during those busy periods to keep you above water during the quieter months.

If you do find that you have a lot of capital tied up in invoices, it may be worth reviewing the payment periods you recommend for your clients.

You could also consider a part-payment system, which involves the client paying some of their bills at the beginning of the project and the remainder at the end.

Lesson 3 – Learning When To Invest

If you’ve got a relatively new business, it’s natural to be ambitious and to want to grow that company quickly.

While expanding can be lucrative, timing is vital. You don’t want to reinvest your profits or borrow money to grow your business at the wrong time.

Wait until you’re generating profits, make sure there’s a clear demand for your products and services, and plan in advance.

More Stories

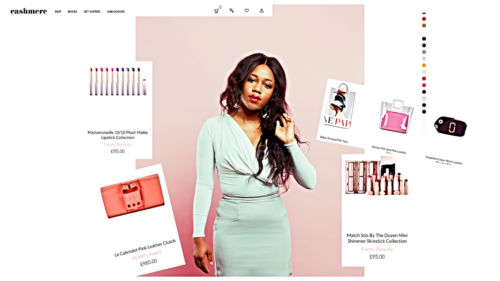

Fashion Meets Finance With Urenna Okonkwo’s ‘Cashmere App’

Back Her Business – New Female-only Crowdfunding Programme Launched By NatWest